Swiggy CEO on Rapido’s food delivery entry: 'Agile and paranoid,' ready to respond swiftly

As Rapido sets its sights on India's bustling food delivery market, Swiggy's founder and CEO, Sriharsha Majety, expressed that the company is "super agile and paranoid" about potential challenges. Speaking at an investor event hosted by Prosus in London, Majety emphasized the complexities of breaking into this competitive landscape. He reflected on the evolving nature of the food delivery sector, recalling how numerous entrants have attempted to establish their presence over the years. "There were a dozen players in food delivery in 2015. By 2017, Uber and Ola joined the fray, followed by Amazon in 2019 and ONDC in 2021," he noted. Majety credited both Swiggy and Zomato for successfully navigating these challenges, asserting, "It’s not easy to find an opening for a home run." In response to concerns about Rapido disrupting the food delivery ecosystem, Majety acknowledged that while Swiggy holds approximately 15% of Rapido and they share a common investor in Prosus, each company will have its own trajectory. "It will be intriguing to see if Rapido can introduce a new approach that invigorates the category, as we are also anticipating further growth," he remarked. He added that should an opportunity arise, Swiggy would not hesitate to seize it swiftly. Rapido, primarily known for its two-wheeler taxi services, has reportedly established its commission structure with restaurant partners. As per a recent ET report, the platform will charge restaurants Rs 25 for orders under Rs 400 and Rs 50 for orders above that threshold, resulting in commission rates that are notably lower—between 8% and 15%—compared to Swiggy and Zomato's typical rates of 16% to 30%. Majety conveyed confidence in Swiggy's adaptability, stating, "If there's an opening, we will be out there in weeks. We will be trying our own luck with the customer to grow the category." He also shared insights on the burgeoning quick commerce sector, projecting its potential growth to $30–40 billion in the next three to five years. However, he cautioned that this market might only sustain two major players, rather than allowing multiple competitors to thrive. "The quick commerce market is moving towards a $30-40 billion size in three to five years, which can support more than two players, but it’s unlikely to accommodate five or six," he explained. Currently, the sector is primarily dominated by Blinkit, Zepto, and Swiggy’s own Instamart, which collectively hold around 85% to 90% of the market share. A recent report from BofA Global Research indicated a slight decrease from the previous 90% to 95% share held just months prior. Other competitors like Tata Digital’s BigBasket, Flipkart Minutes, Amazon Now, and Reliance Retail’s JioMart share the remaining market. Majety anticipates some level of consolidation in the market, noting, "There are three major players and four fringe players. While some consolidation is expected, legacy e-commerce companies may opt to maintain their offerings to stay relevant."

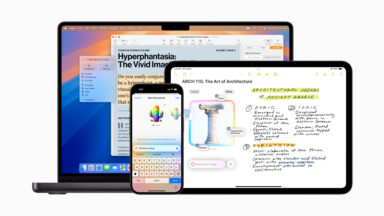

Apple Unveils Significant Updates for iOS, macOS, and More Amid Upcoming Software Transition

In a notable move ahead of its highly anticipated software releases, Apple has rolled out updates for several of its ope...

Ars Technica | Jul 29, 2025, 19:05

Groq Eyes $600 Million Fundraising Round at $6 Billion Valuation Amid AI Chip Market Surge

AI chip startup Groq is reportedly in discussions to secure a substantial $600 million funding round, aiming for a valua...

TechCrunch | Jul 29, 2025, 22:30

Anthropic Eyes Major Funding Boost Valued at $170 Billion Amid Changing Strategies

Anthropic is currently in negotiations to secure between $3 billion and $5 billion in a funding round led by Iconiq Capi...

CNBC | Jul 29, 2025, 19:15

Harnessing Plasma: SOSV's Ambitious Plan to Revolutionize Multiple Industries

Investors at SOSV are making bold moves, believing that plasma technology could redefine various sectors, from energy to...

TechCrunch | Jul 29, 2025, 18:35

Positron Unveils Strategy to Challenge Nvidia in AI Inference Chips

Positron has announced what it believes to be a game-changing approach to compete against Nvidia in the rapidly evolving...

VentureBeat | Jul 29, 2025, 20:10