Rivian CEO RJ Scaringe’s voting control slips following divorce settlement

Rivian's founder and CEO, RJ Scaringe, has made significant changes to his share ownership and voting rights following a recently finalized divorce, as detailed in a regulatory filing. On July 9, Scaringe transferred approximately 4 million shares and 6 million options to his ex-wife, Meagan Scaringe, as part of their divorce agreement. Based on Rivian's current stock valuation, this transfer amounts to an estimated $130 million, although the actual return could vary due to differing strike prices. This adjustment comes after a lengthy two-year divorce process. According to Rivian’s annual proxy report from April 29, Scaringe held over 15 million Class A shares and nearly 8 million Class B shares. The recent transfer has reduced his voting power significantly from 7.6% to around 4%, marking the lowest level since Rivian's initial public offering in 2021. Despite this shift in ownership, Rivian stated that it would not affect the company’s operations or business. In an official statement, a Rivian spokesperson confirmed the divorce and emphasized the couple's commitment to co-parenting their children. The timing of this settlement is crucial for Rivian, which is currently focused on optimizing its R1S SUV and R1T truck models to reduce manufacturing costs and enhance performance. Looking ahead, the company aims to boost sales with the upcoming R2 SUV, priced starting at $45,000, although it will not be available until the first half of 2026. Since Rivian's IPO, the company’s ownership landscape has evolved. Initially backed by major stakeholders like Amazon and Ford, the latter has nearly exited while Volkswagen Group has emerged as a key player. Rivian recently entered a $5.8 billion joint venture with Volkswagen, concentrating on software and electrical architecture, leading to Volkswagen owning 12.3% of Rivian as per the latest filing. Amazon remains the largest shareholder with 14.2%, granting it the most voting power among individual shareholders at 13.3%. Prior to the divorce settlement, Scaringe owned 2% of Rivian but maintained 7.6% voting power, primarily due to the more favorable voting structure of Class B stock, which provides 10 votes per share compared to 1 vote for Class A shares. The shares transferred to his ex-wife will convert from Class B to Class A stock, thus limiting her voting influence relative to other shareholders if she chooses to retain the shares. Scaringe still retains control over approximately 50 million shares, options, and restricted stock units, which could potentially restore his voting power as they vest. Scaringe founded Rivian in 2009, got married in 2014, and led the company to its public debut in 2021. He filed for divorce in October 2023, with the separation agreement finalized the following month.

Anthropic Reaches Settlement in Controversial AI Training Case

Anthropic has reached a settlement in a notable class action lawsuit involving various authors of both fiction and nonfi...

TechCrunch | Aug 26, 2025, 19:00

Samsung Launches Galaxy Tab S10 Lite: The Affordable Tablet Redefining Productivity

Samsung Electronics has introduced the Galaxy Tab S10 Lite, a new tablet designed to be both affordable and versatile fo...

Business Today | Aug 26, 2025, 18:45

Navigating the New Venture Landscape: Insights from Uncork Capital

In a recent episode of StrictlyVC Download, TechCrunch Editor-in-Chief Connie Loizos engages with Jeff Clavier and Andy ...

TechCrunch | Aug 26, 2025, 20:05

SpaceX's Starship Faces Challenges Ahead of Launch Amid Technical Hurdles

In the heart of Texas, SpaceX engineers are gearing up for the third consecutive day of attempts to launch their colossa...

Ars Technica | Aug 26, 2025, 20:05

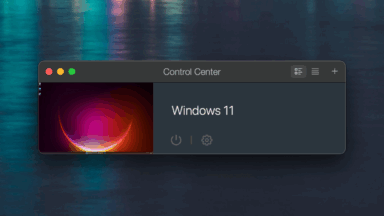

Parallels Desktop 26: A Must-Have for Enterprises, But Minimal Upgrades for Consumers

The latest version of Parallels Desktop has just been released, bringing with it a host of features primarily aimed at e...

Ars Technica | Aug 26, 2025, 20:55